when you buy chanel in paris for tax return | Chanel va tax refund when you buy chanel in paris for tax return To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France . Pašmāju, romantiskās, piedzīvojumu vai detektīvfilmas, dažādu žanru filmas online bezmaksas TV3 Play.

0 · tax free shopping in Paris

1 · tax free department stores in Paris

2 · Paris luxury tax free shopping

3 · Paris luxury tax free department

4 · Chanel va tax refund

5 · Chanel louis vuitton tax refund

6 · Chanel france tax refund

1 Overworld Zones. 2 List of Zones by Region. 2.1 La Noscea. 2.2 The Black Shroud. 2.3 Thanalan. 2.4 Coerthas. 2.5 Mor Dhona. 2.6 Abalathia's Spine. 2.7 Dravania. 2.8 Gyr Abania. 2.9 Hingashi. 2.10 Othard. 2.11 Norvrandt. 2.12 The Northern Empty. 2.13 Ilsabard. 2.14 The Sea of Stars. 2.15 The World Unsundered. 2.16 ??? Overworld Zones.

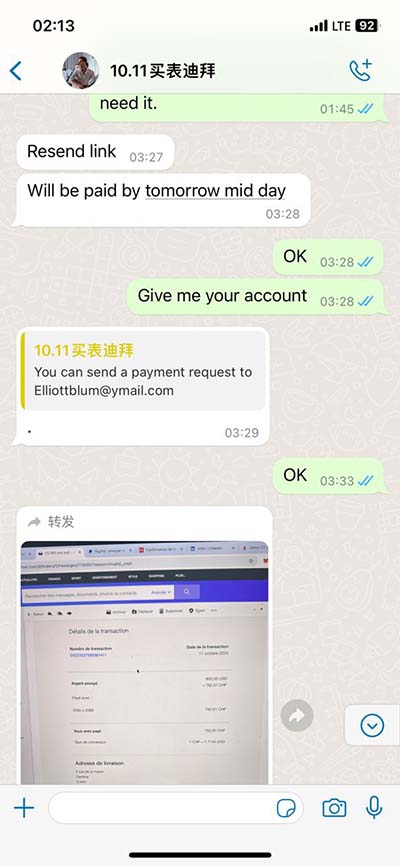

Upon exiting France (or your last EU country) you present the goods and the detax form to be stamped at the Detax desk, you place all the necessary envelopes into the mail slots for them and within 90 days you will receive your refund, usually back to the credit card you . Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de .

Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be .To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France . Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your .

Destination Expert. for Paris, Loire Valley. 30,626 posts. 6 helpful votes. 1. Re: Buying Chanel at CDG Terminal 2E and Tax Refund. 9 years ago. Purchases made at boutiques located in the .You will get a significant discount when buying a bag in Paris or Italy compared to the US (10-13% back), its called VAT (value added tax) refund. Once you make a purchase, the store will give .

Upon exiting France (or your last EU country) you present the goods and the detax form to be stamped at the Detax desk, you place all the necessary envelopes into the mail slots for them and within 90 days you will receive your refund, usually back to the credit card you used to purchase the item.

Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it!

tax free shopping in Paris

where to buy dolce and gabbana nail polish

To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France for a limited time! Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first.

Destination Expert. for Paris, Loire Valley. 30,626 posts. 6 helpful votes. 1. Re: Buying Chanel at CDG Terminal 2E and Tax Refund. 9 years ago. Purchases made at boutiques located in the airport´s international departure areas are tax free. There is no additional refund.You will get a significant discount when buying a bag in Paris or Italy compared to the US (10-13% back), its called VAT (value added tax) refund. Once you make a purchase, the store will give you specific forms. No, the VAT refund scheme applies to all EU countries that participate. You can collect all your stamped documents and have them verified at your exiting airport. You can also drop off your VAT documents in the city offices and not at the airport when you’re in France. They’ll just need to see proof of you exiting the country.

Tax are included in the price, and you’ll get 12% back for VAT refund. However, it will just make the Paris prices slightly cheaper than the US, not a lot of saving because the price in Euro is higher than retail here in the US. While it’s true that purchasing Chanel products directly from French boutiques may be slightly cheaper than buying them elsewhere due to VAT (Value-Added Tax) refunds for tourists, other factors must be considered.

buy fendi casa extended stay apartments lebanon

Upon exiting France (or your last EU country) you present the goods and the detax form to be stamped at the Detax desk, you place all the necessary envelopes into the mail slots for them and within 90 days you will receive your refund, usually back to the credit card you used to purchase the item. Discover the ultimate guide to luxury tax-free shopping in Paris, including the VAT refund process. Learn how to navigate tax-free departments, process your forms at Charles de Gaulle Airport, and indulge in duty-free shopping. Currently the vat rate is 20%, which is nothing to sneeze at on luxury items. So for any of you dreaming about buying your first Chanel bag in Paris, that VAT return will be significant. Here’s how to make sure you get it!To help you make the most of tax-free shopping in France this spring, Wevat is accepting invoices from Louis Vuitton, Chanel, Dior, Céline, and Hermès for all eligible tourists traveling to France for a limited time!

Every traveler abroad is required to declare all their purchases made outside the U.S. When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first.Destination Expert. for Paris, Loire Valley. 30,626 posts. 6 helpful votes. 1. Re: Buying Chanel at CDG Terminal 2E and Tax Refund. 9 years ago. Purchases made at boutiques located in the airport´s international departure areas are tax free. There is no additional refund.

You will get a significant discount when buying a bag in Paris or Italy compared to the US (10-13% back), its called VAT (value added tax) refund. Once you make a purchase, the store will give you specific forms. No, the VAT refund scheme applies to all EU countries that participate. You can collect all your stamped documents and have them verified at your exiting airport. You can also drop off your VAT documents in the city offices and not at the airport when you’re in France. They’ll just need to see proof of you exiting the country. Tax are included in the price, and you’ll get 12% back for VAT refund. However, it will just make the Paris prices slightly cheaper than the US, not a lot of saving because the price in Euro is higher than retail here in the US.

tax free department stores in Paris

dolce gabbana millennial skin buy online

Fine Line Reduction. more info. Lip Filler. more info. Sculptra. more info. Sculptra Butt Lift. more info. Under Eye Filler. more info. The Look Med Spa in Las Vegas is an award-winning medical spa specializing in injectables & fillers for .

when you buy chanel in paris for tax return|Chanel va tax refund